-

Abstract:

We develop a test for deciding whether the linear spaces spanned by the factor exposures of a large cross-section of assets towards latent systematic risk factors at two distinct points in time are the same. The test uses a panel of asset returns, with both the number of assets and the number of return observations per asset increasing asymptotically while the length of both time windows is shrinking. We estimate the factor exposures, up to rotation, over the two periods using classical principal component analysis and evaluate their projection discrepancy, which is rotation invariant. This projection discrepancy is then centered with one between factor exposures computed over a partition of the pooled return data into odd and even increments. We derive the limit distribution of the statistic under the null hypothesis. It is mixed Gaussian and depends both on the idiosyncratic risk in asset returns as well as on the realization of common, for all assets, shocks over the two periods. The test is applied to intraday financial data to determine whether the linear span of assets' systematic risk exposures differ during a trading day or after a release of important economic information.

- Paper:

PDF file

- Empirical result:

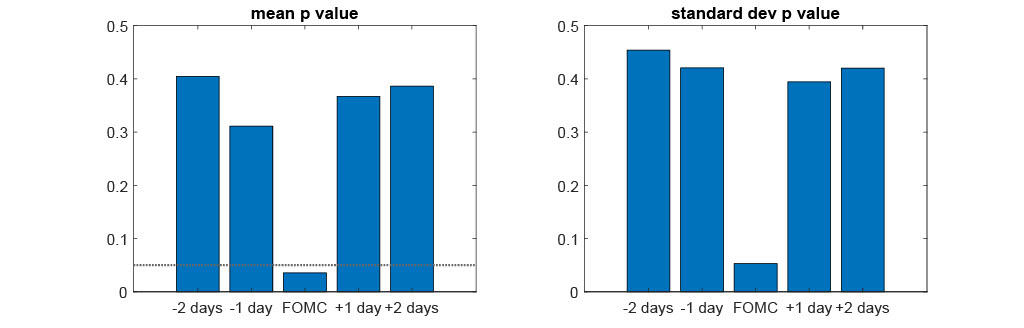

P-values of test for equal linear spans of factor exposures at market open and

market close on days around FOMC announcement. In the horizontal axis, “t days” means

the test is conducted for data on the FOMC+t day.

- Simulation: Matlab code